National debt doesn’t matter, right up until the moment when it is practically the only thing which matters. The debt crises of the 1990s and the European Debt Crisis of the 2010s show us that deficit and/or debt levels can grow gradually, with little or no discernible consequences, and then suddenly dominate the headlines and collapse currencies, economies, and markets. There appears to be an important psychological barrier somewhere around the 100% debt-to-GDP ratio or above. The book “This Time Is Different: Eight Centuries of Financial Folly” by Carmen M. Reinhart and Kenneth S. Rogoff argued that above that point, growth tends to decline.

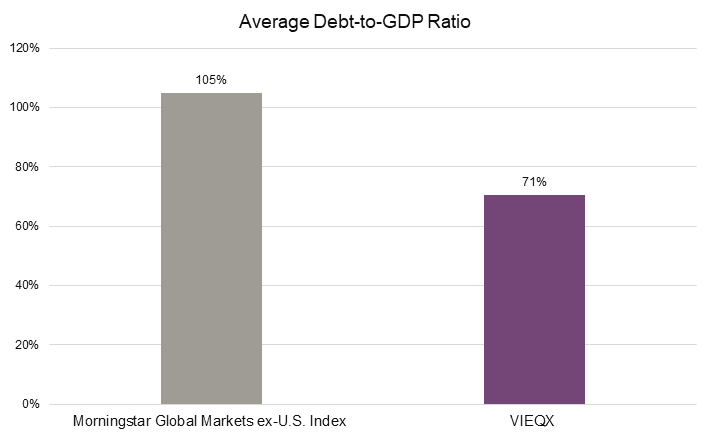

The Vident Core International Equity Index™ (VIEQX) had an average 71% debt-to-GDP ratio, whereas a comparison benchmark, the Morningstar Global Markets ex-U.S. Index, was 105%, which reflects at least two factors: VIEQX allocated towards emerging markets and away from debt-laden Europe.

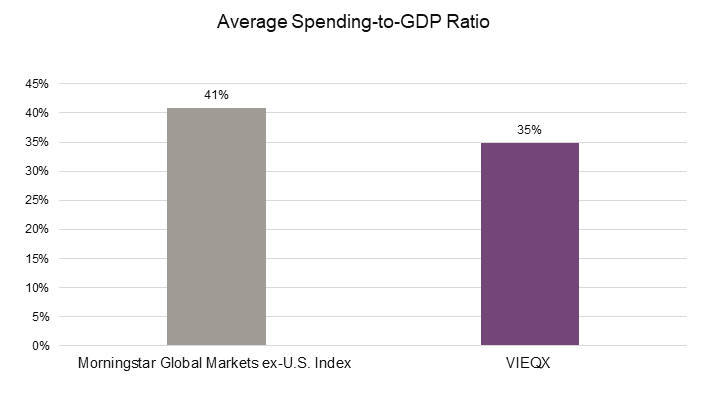

Of course, the driver of debt tends to be spending. Tax revenue growth is seldom able to keep up with political demands for spending, which is why debt trends upwards. VIEQX had an average 41% government spending-to-GDP ratio, whereas the Morningstar Global Markets ex-U.S. Index was 35%.

Excess government spending can be a drag on the economy, as can debt. In recent years, artificially-low global interest rates have cushioned the debt burden to some degree, because a lower interest rate applied to a same debt level keeps annual debt service payments relatively-low. In a global environment of rising interest rates, high debt levels leave nations vulnerable to debt service increases and possible crises. Debt might once again go from something that doesn’t matter to the only thing which matters rather quickly.

Index Definitions:

The Vident Core International Equity IndexTM is a strategy seeking to balance risk across developed and emerging countries and emphasize those with favorable conditions for growth.

The Morningstar Global Markets ex-U.S. Index measures the performance of the stocks located in the developed and emerging countries across the world (excluding the United States) as defined by Morningstar.

An investor cannot invest directly in an index.

The opinions expressed herein are those of Vident Financial at the time of publication and are subject to change. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. Recipients should not rely on this material in making any future investment decision.

Investors cannot invest directly in an index. Indexes are not managed and do not reflect management fees and transaction costs that are associated with some investments. Past performance does not guarantee future results.