By mathematical necessity, the productivity of a nation is the average productivity of each person times the number of people. This means that growth and shrinkage come from a combination of changes in individual productivity and changes in population – the fewer the workers, the more work the remaining workers have to do to compensate. If population declines, the only way to grow is for individual value creation to grow fast enough to outpace the decline in population.

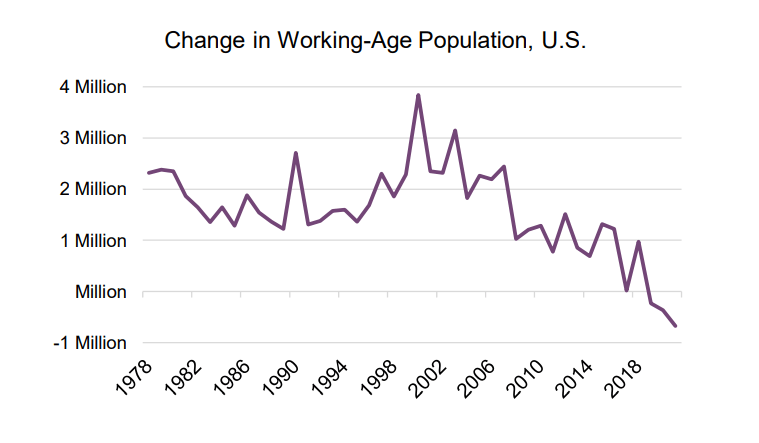

For example, the United States has a well-publicized labor shortage. At least part of that problem is related to an aging population. As you can see below, 1-year change in working age population (the number of people who are aged 18-65) has been darting in and out of negative territory since 2017.

This is a headwind for the U.S., both for the growth outlook and because of the fiscal problems associated with funding social security and other age-related entitlement programs. As such, declining U.S. demographics is relevant to the issue of investor ‘home bias’, the tendency for people to heavily allocate investments in the country where they live.

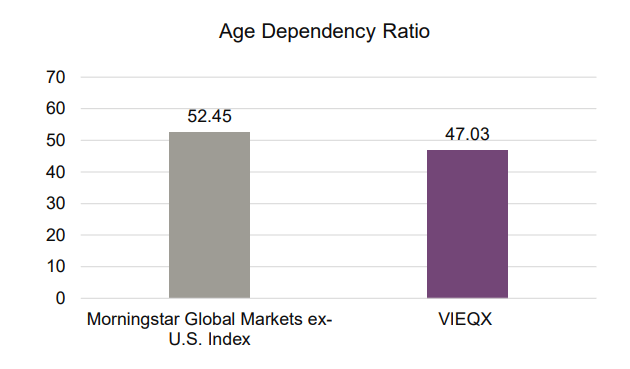

But aging population is not just relevant to the issue of whether to diversify away from high concentrations in the U.S. in building indices, it’s also relevant to how to allocate to non-U.S. countries. The Vident Core International Equity Index™ (VIEQX) is more demographically balanced than a comparison benchmark, Morningstar Global Markets ex-U.S Index, as demonstrated by something called ‘the age dependency ratio’, which is the number of people not of working age divided by the number of people who are of working age.

The higher the age dependency ratio, the more people who are not in the typical working age range depending on those who are. And as that ratio gets unbalanced, countries veer closer and closer to the situation which preceded the European Debt Crisis (Europe’s struggle to pay the debts it had built up in preceding decades) that began in 2010, and the very poor stock and currency performance that came with it.

In all the abstractions of finance, economics, GDP, inflation, and employment, it’s easy to forget the real thing without which none of those things would exist – people.

Index Definitions:

The Vident Core International Equity IndexTM is a strategy seeking to balance risk across developed and emerging countries and emphasize those with favorable conditions for growth.

The Morningstar Global Markets ex-U.S. Index measures the performance of the stocks located in the developed and emerging countries across the world (excluding the United States) as defined by Morningstar.

An investor cannot invest directly in an index.

The opinions expressed herein are those of Vident Financial at the time of publication and are subject to change. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. Recipients should not rely on this material in making any future investment decision.

Investors cannot invest directly in an index. Indexes are not managed and do not reflect management fees and transaction costs that are associated with some investments. Past performance does not guarantee future results.