After World War II, the U.S. was almost half of global economic output. Now it’s about a fourth. It’s not that the U.S. didn’t grow, it’s just that the rest of the world grew faster.

It should come as no surprise that the U.S. is no longer such a large percentage of the global economy – looking at the last 2,000 years of economic history, China was the largest economy in the world for about 1,870 of those years, only being surpassed by the U.S. after our own civil war. India was 2nd, behind China and ahead of the U.S. for the vast majority of those years as well. The American economic colossus after the war was the historical anomaly, and our shrinking share is a regression to the mean of normal history.

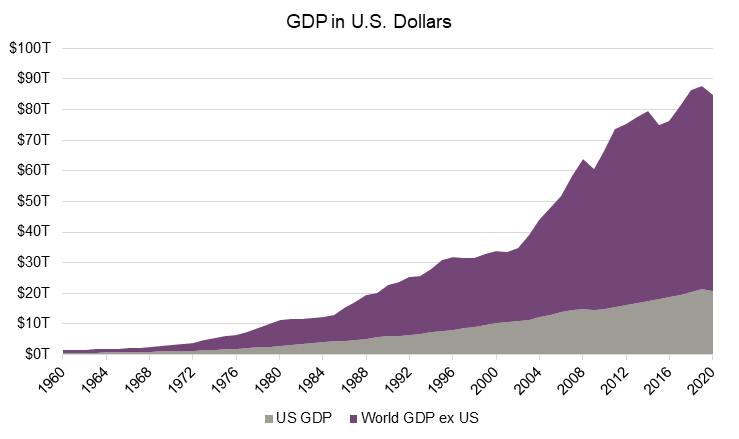

As you can see in the chart below, which shows world GDP in comparison with U.S. GDP since 1960, that declining share came in fits and starts.

The deregulation of China in the 1970s was a major inflection point. The bursting of the tech bubble and the following recession in 2001 was also a similar shift, though the European Debt Crisis that began in 2010 and its aftermath slowed the relative decline a bit. But, even if somewhat unevenly, the U.S. has been fading into a more normal relationship with the world. Since earnings growth tends to correlate over the long run with GDP growth, investors should not ignore this.

This means that investors cannot tap into the whole world growth story by just investing in the U.S. Year after year, more and more of the economic value created by the human race is created by non-Americans. This is another blow against the investment fallacy known as ‘home bias’ (more about that here and here).

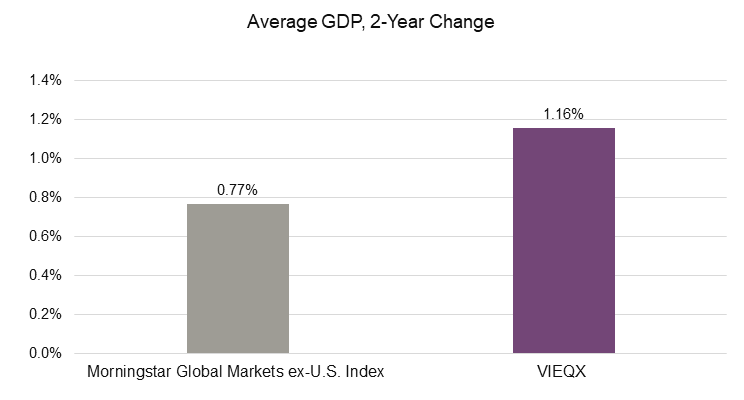

However, the global GDP story, is not just about allocating investment options beyond the U.S., it’s also about how to allocate the non-U.S. assets between different nations. The Vident Core International Equity Index™ tends to be overweight emerging markets and Asia compared to cap-weighted indices, which tend to focus more on Europe and developed markets. We believe this gives the Vident index a growth advantage, which you can see in the chart below. This shows that the average growth rate for the Vident index was higher than that of a comparison benchmark, the Morningstar Global Markets ex-U.S. (if both of these numbers seem relatively low, you can thank recent COVID-19 disruptions):

It has seldom been smart to bet against the U.S. entirely, but it’s not a smart bet to limit one’s index construction to only 1/4th of the world, especially when that 1/4th is having trouble keeping up with much of what is going on in the emerging parts of the rest of the world. We think it’s wise for portfolios with a long time horizon to consider moving some allocations from lower growth indices to higher growth ones.

It has seldom been smart to bet against the U.S. entirely, but it’s not a smart bet to limit one’s index construction to only 1/4th of the world, especially when that 1/4th is having trouble keeping up with much of what is going on in the emerging parts of the rest of the world. We think it’s wise for portfolios with a long time horizon to consider moving some allocations from lower growth indices to higher growth ones.

Index Definitions:

The Vident Core International Equity IndexTM is a strategy seeking to balance risk across developed and emerging countries and emphasize those with favorable conditions for growth.

The Morningstar Global Markets ex-U.S. Index measures the performance of the stocks located in the developed and emerging countries across the world (excluding the United States) as defined by Morningstar.

An investor cannot invest directly in an index.

The opinions expressed herein are those of Vident Financial at the time of publication and are subject to change. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. Recipients should not rely on this material in making any future investment decision.

Investors cannot invest directly in an index. Indexes are not managed and do not reflect management fees and transaction costs that are associated with some investments. Past performance does not guarantee future results.